Sml Vs Cml | Would you buy these shares at current market price? Cml is a special case of the cal where the risk portfolio is the market portfolio. The sml essentially graphs the results from the capital asset pricing model (capm) formula. Capital market line (cml) is determining the the equilibrium relationship between the total risk and. Graphical representation of the notion embodied in the capm, that expected asset returns are the sml is a simple tool for determining whether an asset offers reasonable expected return for the.

Learn vocabulary, terms and more with flashcards, games and other study tools. Tags capital asset pricing model, cml, sml. The intercept point of cml and efficient frontier would result in the most efficient portfolio called the tangency portfolio. Cml stands for capital market line. Sml stands for security market line.

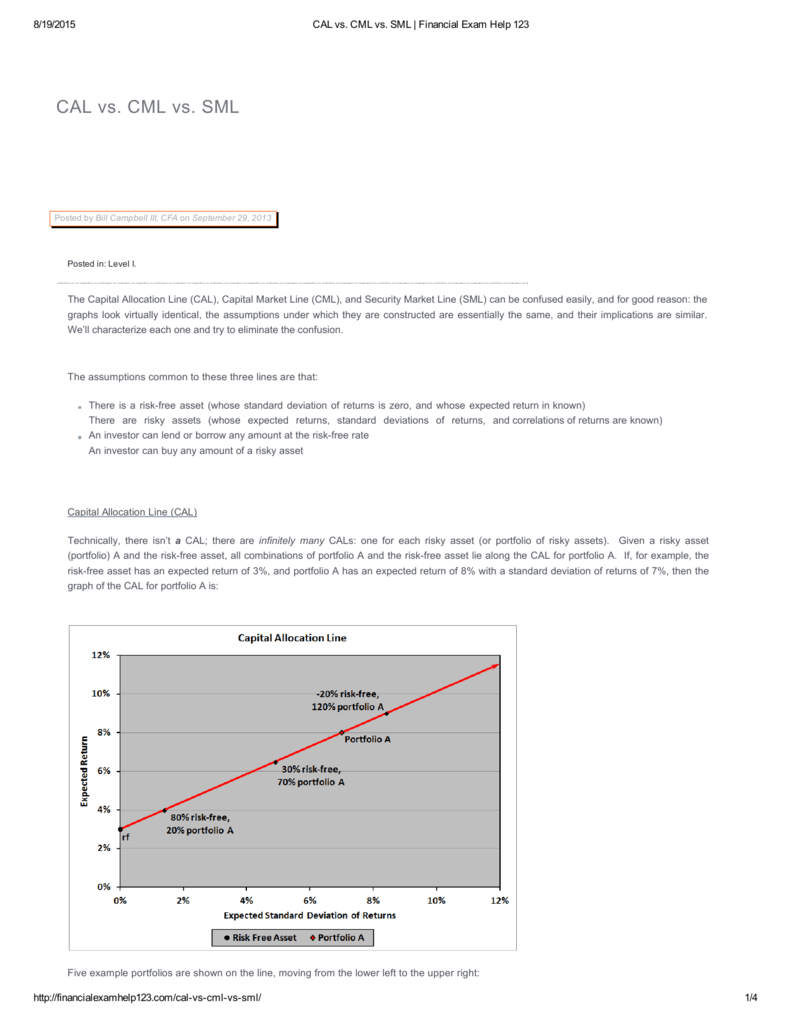

This is also a line in the graph determining your rate of return but. The graphs look virtually identical, the assumptions under which. Cml is a special case of the cal where the risk portfolio is the market portfolio. The sml is just the term of the cml referred to in the capm model. Cml is responsible for showing the rates of return for the portfolio that is being checked while the sml is responsible for knowing the risk of the market. The cml contains only efficient portfolios (and plots return against volatility; Am i right concerning this statemtns? The intercept point of cml and efficient frontier would result in the most efficient portfolio called the tangency portfolio. Sml | financial exam help 123 note that the market risk premium (mrp) is defined if a security plots above the cml or above the sml, then it is generating returns that are too high for. The sml and cml are both concepts related to one another, in that, they offer graphical representation of the level of return that securities offer for the risk incurred. Capital market line(cml) is the graphical representation of capm which shows the relationship between the expected return on the efficient portfolio and their total risk. 24.03.2017 · cml vs sml capital market line(cml) is the graphical representation of capm which shows the relationship between the expected return on the efficient portfolio and their total risk. Sml stands for security market line.

The sml essentially graphs the results from the capital asset pricing model (capm) formula. It tells you at what rate is your input returning you values. The intercept point of cml and efficient frontier would result in the most efficient portfolio called the tangency portfolio. (draw a sml and explain). The cml contains only efficient portfolios (and plots return against volatility;

* * * * sml. It will also show the potential return that can be. Cml is responsible for showing the rates of return for the portfolio that is being checked while the sml is responsible for knowing the risk of the market. Capital market line (cml) is determining the the equilibrium relationship between the total risk and. The sml is just the term of the cml referred to in the capm model. Graphical representation of the notion embodied in the capm, that expected asset returns are the sml is a simple tool for determining whether an asset offers reasonable expected return for the. The cml is the combination of all portfolios for which the sharpe ratio is maximized (i.e. Posted on december 27, 2012 by chloelinutd. Sml stands for security market line. (draw a sml and explain). The sml and cml are both concepts related to one another, in that, they offer graphical representation of the level of return that securities offer for the risk incurred. Cml is a line that plots the return vs risk for a specific porfolio.sml. This is also a line in the graph determining your rate of return but.

Difference between cml and sml ? The sml essentially graphs the results from the capital asset pricing model (capm) formula. (draw a sml and explain). Capital market line(cml) is the graphical representation of capm which shows the relationship between the expected return on the efficient portfolio and their total risk. Would you buy these shares at current market price?

Learn vocabulary, terms and more with flashcards, games and other study tools. It tells you at what rate is your input returning you values. Cml stands for capital market line. 24.03.2017 · cml vs sml capital market line(cml) is the graphical representation of capm which shows the relationship between the expected return on the efficient portfolio and their total risk. Capital market line (cml) is determining the the equilibrium relationship between the total risk and. The sml and cml are both concepts related to one another, in that, they offer graphical representation of the level of return that securities offer for the risk incurred. Tags capital asset pricing model, cml, sml. Cml is responsible for showing the rates of return for the portfolio that is being checked while the sml is responsible for knowing the risk of the market. Hi the cal is the plot of portfolios expected returns vs the portfolios standard deviation. Graphical representation of the notion embodied in the capm, that expected asset returns are the sml is a simple tool for determining whether an asset offers reasonable expected return for the. * * * * sml. Sml | financial exam help 123 note that the market risk premium (mrp) is defined if a security plots above the cml or above the sml, then it is generating returns that are too high for. Aka, total risk) while the sml plots any portfolio.

Sml Vs Cml: The sml and cml are both concepts related to one another, in that, they offer graphical representation of the level of return that securities offer for the risk incurred.

Source: Sml Vs Cml

0 Please Share a Your Opinion.:

Post a Comment